Are you looking for a way to get higher returns than today’s paltry cd rates, money market rates, and savings accounts? We’re always on the lookout for low risk high return investments.

Betterment provides a way to invest in the bond/stock market in a simple way where you simply control the allocation.

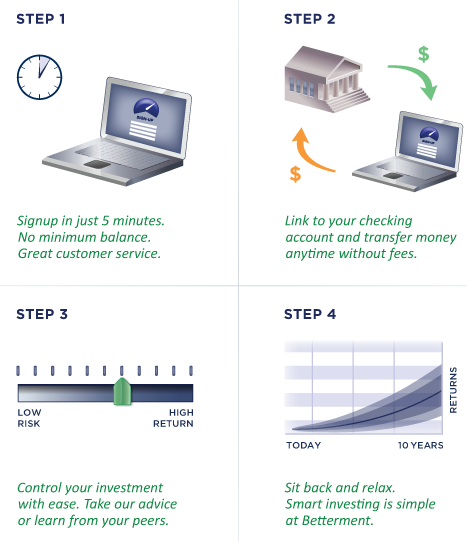

There are three steps to getting started with Betterment:

1. Signup online at Betterment.com

2. Link your checking account and transfer money (no fees)

3. Adjust the risk/return slider to change the allocation of your money between stocks and bonds and watch your money grow (hopefully). That’s it.

The first thing to consider with any investment is capital preservation/risk. Betterment allocates your money between US stock market ETFs and bond ETFs.

Betterment Stock Market Exposure

Betterment’s stock market basket consists of:

- 20% Vanguard Total Stock Market

- 20% iShares S&P 500 Value Index

- 20% iShares S&P 1000 Value Index

- 15% iShares Russell 2000 Value Index

- 15% iShares Russell Midcap Value Index

- 10% DIAMONDS Trust Series 1

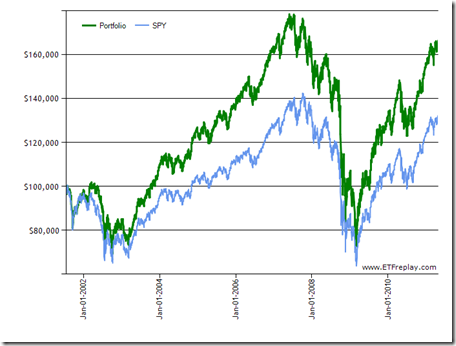

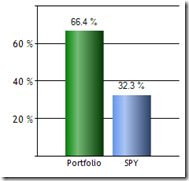

Here is a chart showing how a portfolio with Betterment completely allocated to stocks would perform compared to they S&P 500 ETF SPY over the last 36 months:

The portfolio’s total return for the last 10 years would be 66.4%  minus Betterment’s management fee (ranges from 0.3% to 0.9% annually). The S&P 500 ETF returned 32.3% over the same period. The portfolio had an annualized volatility of 22.2% while the SPY ETF had a volatility of 21.6%. Higher volatility indicates greater fluctuations and higher risk.

minus Betterment’s management fee (ranges from 0.3% to 0.9% annually). The S&P 500 ETF returned 32.3% over the same period. The portfolio had an annualized volatility of 22.2% while the SPY ETF had a volatility of 21.6%. Higher volatility indicates greater fluctuations and higher risk.

Betterment Bond Market Exposure

The bond market basket includes only two ETFs:

- 50% iShares Barclays TIPS Bond Fund

- 50% iShares Barclays 1-3 Year Treasury Bond Fund

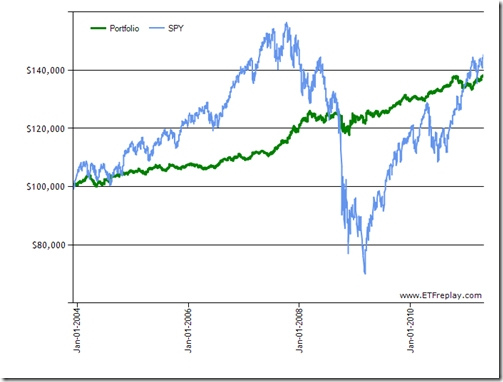

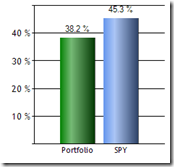

Here is a backtest of the last 7 years with a full allocation to the Betterment Bond Market Basket:

The total return on the bond portfolio rang in at 38.2% while the S&P  500 registered a 45.3% return. Even though the bond portfolio return was less than the SPY, the volatility was also significantly less indicating less risk. Annualized volatility of the bond portfolio was 4.2% versus the S&P 500’s 21.4%.

500 registered a 45.3% return. Even though the bond portfolio return was less than the SPY, the volatility was also significantly less indicating less risk. Annualized volatility of the bond portfolio was 4.2% versus the S&P 500’s 21.4%.

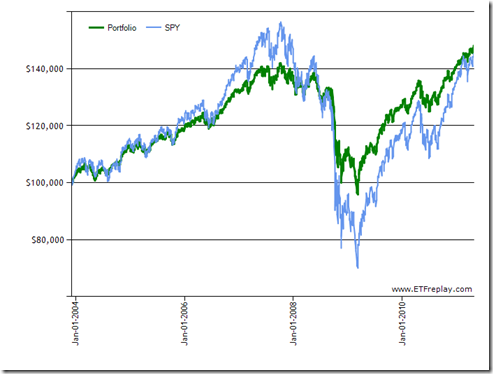

50/50 Bond and Stock Allocation

Suppose you had invested with Betterment for the last 7 years allocating half of your funds to stocks and half to bonds. What would your return look like?

The total return on the balanced portfolio would be essentially the same as the S&P 500 (48% vs 45.3%) but the volatility would be half as much (10.6% vs 21.4%).

Betterment Fees

Now that you have seen visually what your returns would have been historically with Betterment, let’s look at how fees would’ve reduced them.

Betterment charges fees similar to tax rates; on a margin scale based on the amount in your account:

| Portion of Balance | Fee charged |

| $0 – $25,000 | 0.90% |

| $25,000 – $100,000 | 0.70% |

| $100,000 – $500,000 | 0.50% |

| $500,000+ | 0.30% |

This means that no matter how much you have in your account, you’ll still pay 0.90% on the first $25,000. If you maintain $500,000 in your account you’ll pay $2750 per year which equals a 0.55% fee.

Better Betterment Alternatives?

1. You can completely mirror Betterment’s portfolio for a tiny fraction of the cost. Simply sign up for a discount broker account like TradeKing and you only pay a one-time fee of $4.95 to purchase each ETF in Betterment’s portfolio. If you bought all 8 ETFs you would pay a commission of $39.60 and you could keep your position year after year without paying a management fee. Of course you will have to rebalance the portfolio on a quarterly or semi-annually basis and you’ll have to pay the trading commissions again but it still won’t cost near as much as Betterment.

2. Don’t forget you can avoid the extreme risks of the stock and bond market by simply opening a money market account, high yield CD account or online savings account.

3. You can also have much more control over your investing while still keeping it simple with the much more versatile FolioInvesting.com (review coming soon).

4. GoalMine is definitely not better, just different and mainly focused on mutual funds and one savings account from Bancorp which currently pays 0.25% APY. We will review GoalMine soon.