Have you found you tend to overspend using your credit cards just to earn reward points? Wouldn’t it be nice to earn cash back on your debit card purchases? PerkStreet Financial offers the highest cash back rewards debit card in the nation.

Have you found you tend to overspend using your credit cards just to earn reward points? Wouldn’t it be nice to earn cash back on your debit card purchases? PerkStreet Financial offers the highest cash back rewards debit card in the nation.

With the PerkStreet Debit Card, you earn 2% on every non PIN debit card purchase – as long as you don’t enter your PIN, you get cash back. This includes small dollar purchases which don’t require a signature, internet, phone, or mail-order purchases, and even bill payments. It is also safer to avoid entering your PIN since PIN based transactions don’t qualify for fraud protection and once your PIN is obtained by an unscrupulous person, they can drain your account. Learn how to better protect yourself when using your debit/ATM card here.

Is PerkStreet Financial Safe?

All PerkStreet Financial accounts are FDIC insured through Bancorp ![]() Bank which has a four star rating from Bauer Financial. This means Bancorp has excellent financial strength and is an above average bank.

Bank which has a four star rating from Bauer Financial. This means Bancorp has excellent financial strength and is an above average bank.

How to Earn 2% and 5% Cash Back Rewards

Below are the requirements of the offer:

- Open a checking account with PerkStreet Financial and make PIN-less debit card purchases

- Maintain a balance of $5000 in the PerkStreet Checking Account in order to earn 2% (otherwise you only earn 1%)

- Earn 5% cash back on purchases if they are in a PowerPerks category (changes every month). The 5% cash back has an annual limit of $250 per household.

Fees and Fine Print (Good and Bad)

Here are the details of this checking account and debit card offer:

- No limit on the amount of cash rewards you can accumulate

- No annual fee

- $4.50 fee for any month with no account activity (activity includes any transaction that moves money into or out of your account)

- $25 overdraft fee

- $23 returned item/insufficient funds fee

- Use 37,000 ATMs fee-free nationwide – there is a $2 fee for non STAR® ATMs

- Live phone support, 24/7 @ 866.792.2834

- No minimum balance required

- Fast and secure online account sign up with only $25 minimum opening deposit

- Free online banking and bill pay

- All Deposits are FDIC-insured up to $250,000

Click here to visit the PerkStreet Financial website.

Redeeming Rewards

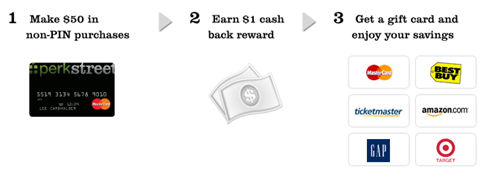

No discussion of a cash back offer is complete without examining how to redeem rewards. With PerkStreet, you will be mailed a gift card. You have four choices:

- MasterCard loaded with your points

- Gift card from Target®, Best Buy®, Amazon.com®, GAP and Ticketmaster®

- Gift card for iTunes, Amazon or Rhapsody

- Gift card for StarBucks, Dunkin’ Donuts, Bruegger’s, or Peets

PerkStreet Created a Better Debit Card

PerkStreet has been successfully offering 2% cash back for years while there have been other banks who’ve tried to do this and failed. Charles Schwab Brokerage once did and has since shut the program down.

The reason PerkStreet can offer this unusual rate is they earn revenue every time customers make a PIN less debit card purchase. PerkStreet also is profitable because it requires a balance of $5,000 for customers who want to earn 2% cash back and it charges a monthly inactivity fee.

All in all, this is a one-of-a-kind debit card and checking account combo. It’s unusual for a rewards program of any kind to have no cash back limit. The average household spending $2500 a month would earn over $600 per year with the card.

Compared to SmartyPig’s savings account with a fee-free no strings attached prepaid debit card, PerkStreet’s debit card still wins out because it is easier to earn cash back than to earn interest. To earn $600 in interest at 1.35% (current SmartyPig APY) in 1 year requires maintaining a balance of $44,444 in your savings account.

You can apply for the PerkStreet Debit Card and Checking Account here.

Remember to compare your savings rate with today’s best money market rates and savings account rates with our daily charts.