Today the S&P 500 is rallying; currently up 1.91%. Does this mean the market is set to continue rallying?

In any market there are bulls and bears. The cup seems to always be half full or half empty regardless of the news.

Here are some reasons the Dow and the S&P 500 will decline for the next week or two:

- For months corporations are amassing cash (possibly preparing for another crisis in the credit markets)

- New claims for unemployment benefits rose unexpectedly last week

- Market is short term overbought

- Consumer debt is still astronomical

- Earnings season is around the corner and bad news is sure to surface

- Ireland's GDP is contracting again

- Fundamentals of the economy are clearly not positive; the economic recovery has slowed

- The S&P 500 is bumping up against resistance at 1152 established from January 11th to January 20th 2010

- AAII Sentiment Survey hit 50.9% last week – this is unusually high, and a great contrarian indicator

Here are some reasons the market will continue to rise:

- The S&P 500 broke through resistance at 1132

- The Democrats will release as much positive economic news as possible to help them in the November elections

- The market has already climbed much higher than traders would expect taking into account the economic environment.

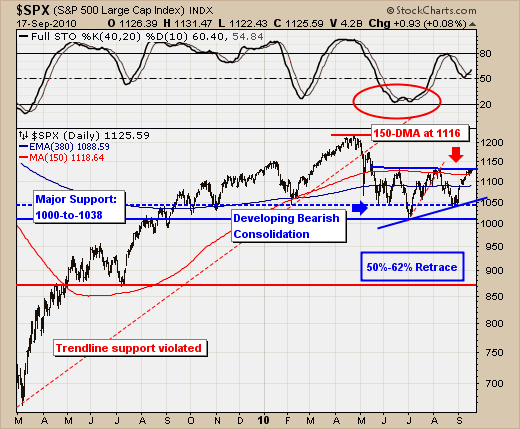

Here is a chart showing a bearish wedge of consolidation and fibonacci support levels:

Here are some sources for research:

http://www.ritholtz.com/blog/2010/09/10-things-making-me-nervous/

http://seekingalpha.com/article/226607-a-warning-for-the-bulls?source=hp_mostpopular

http://seekingalpha.com/article/226832-are-stocks-breaking-out-of-their-summer-range?source=hp_wc

http://seekingalpha.com/article/226743-look-out-below?source=yahoo#comments_header

http://blogs.stockcharts.com/chartwatchers/2010/09/sp-500-headed-to-historical-october-bottom.html