To get the best benefits from your purchases, you need a credit card that is on your side. The new Visa Black Card is not only on your side, but is the ultimate way to demand the best out of your buying experiences. This new credit card has limited membership and is very particular about who joins, but if you fit the mold, this credit card could be the best tool to have in your wallet.

To get the best benefits from your purchases, you need a credit card that is on your side. The new Visa Black Card is not only on your side, but is the ultimate way to demand the best out of your buying experiences. This new credit card has limited membership and is very particular about who joins, but if you fit the mold, this credit card could be the best tool to have in your wallet.

Black Card Benefits

Credit cards now seem to offer some type of rewards to their members for using their credit card to make everyday purchases. Some cards offer cash back, travel rewards, or exclusive benefits just for those lucky enough to be a cardholder. The Visa Black Card is no different and repays its customers in many different ways for the purchases you make with your Black Card.

By being a Visa Black Card holder, you will have access to the Exclusive Rewards Program. Through this programs, you can earn points back on the money you spend with this credit card, by earning one percent cash back on purchases. If you are interested in travel rewards, you can redeem your points for airfare. The points can be redeemed for flights on any airline. The Visa Black Card promises that there are no blackout dates or restrictions when you book your flights. On top of that, cardholders of the Visa Black Card will also receive VIP access to over 600 airport lounges around the world.

Visa Black Card members also receive concierge services 24 hours a day. Members have the access of assistance whenever they need help, whether it be for business, travel or personal needs. As a Black Card member you will also enjoy using a credit card that offers peace of mind. This credit card is accepted in over 170 countries across the world. Plus, Black Card holders are provided with Zero Liability protection services against unauthorized purchases.

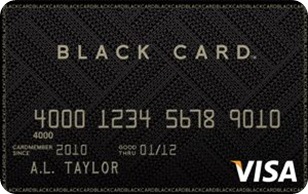

Cardholders of the Visa Black also receive benefits such as luxury gifts from some of the worlds top brands. The Visa Black Card is uniquely made with carbon, which is a design that will definitely get you noticed when you use this credit card to make purchases.

As previously mentioned, this credit card has a limited number of memberships available. You might see the limited membership as a strange tactic for a credit card to offer. But, the limited membership ensures that the Black Card is able to provide cardholders with ultimate personal services and benefits.

Fees and Rates

This credit card has a fee of $495 a year. For additional users added to the account, the annual fee is $195 per user. This high annual fee means the Black Card is not for consumers who make small purchases with their credit card. This credit card is a rewards card for those who travel frequently and spend large amounts of money with a credit card. Other fees apply to the Black Card for late or returned payments, as well as foreign transactions, cash advances and balance transfers. The annual percentage rates for the Black Card is 14.99%. This APR could change depending on the market.

Applying

Applying for the Visa Black Card is easy and can be done online, through their official website. If you use your credit card often, for large amounts, this credit card is right for you. To make sure you are getting the best credit card available to fit your needs, compare the different cards though the comparison chart. If the Visa Black Card fits you best, then become a cardholder and enjoy the benefits this credit card offers to those lucky enough to become a member.