A great way to grow your money is by investing it into the Ally money market account. Ally Bank has continued to provide customers with high interest rates on savings accounts and remain at the top of online comparison charts for their higher interest rates and excellent account features. When you open a money market account with Ally Bank, here are a few of the features you can expect to see:

A great way to grow your money is by investing it into the Ally money market account. Ally Bank has continued to provide customers with high interest rates on savings accounts and remain at the top of online comparison charts for their higher interest rates and excellent account features. When you open a money market account with Ally Bank, here are a few of the features you can expect to see:

- No minimum deposit requirement

- No fees to maintain the account

- Daily compounded interest

- FDIC insured

- 6 monthly transactions

Why Use Money Market Accounts?

When you compare different ways to save your money, the money market account offered from Ally Bank continues to remain at the top of the list. The interest rate paid on a money market account is 5 times higher from the interest rate on a traditional savings account. This allows you an easy way to build up your savings account for whatever your needs may be.

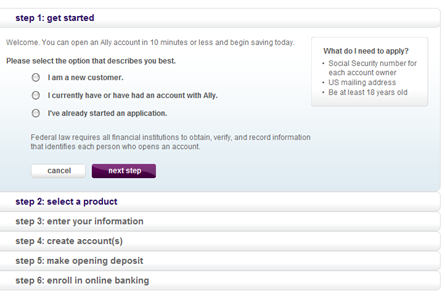

Opening An Ally Bank Money Market Account

Over the years Ally Bank has continued to offer some of the highest interest rates for money market accounts. While the rates are all hovering around 1% lately, they are bound to go back up again when the economy does eventually begin to rebound and you can easily earn interest rates of 4% or higher. Since Ally Bank doesn’t require an initial deposit amount, it helps to make it one of the best banks to work with. Many of the others have deposit requirements and monthly fees just to maintain your account. This can cause you to struggle to even earn interest money on your account.

Over the years Ally Bank has continued to offer some of the highest interest rates for money market accounts. While the rates are all hovering around 1% lately, they are bound to go back up again when the economy does eventually begin to rebound and you can easily earn interest rates of 4% or higher. Since Ally Bank doesn’t require an initial deposit amount, it helps to make it one of the best banks to work with. Many of the others have deposit requirements and monthly fees just to maintain your account. This can cause you to struggle to even earn interest money on your account.

Comparing Money Market Rates

As you compare money market rates you will see that Ally Bank does remain on the list quite often. It has continued to offer higher interest rates and account flexibility, which makes it quite popular. As an online bank, Ally Bank also continues to provide quality customer service with an easy to use website. Compare money market rates today in order to find the best bank to help you start saving your money!